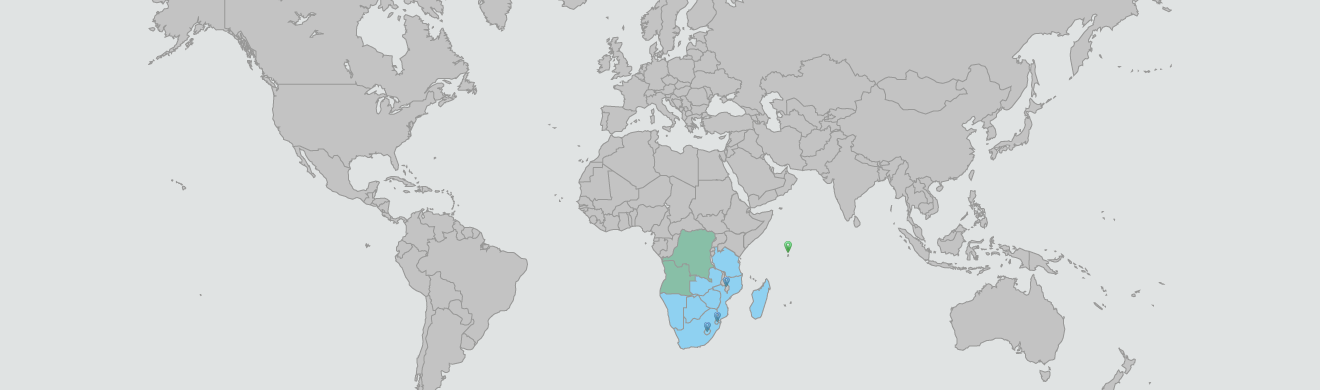

Southern African Development Community (SADC)

The SADC Free Trade Area (FTA) was officially launched in August 2008 by 12 of the 15 Member States. The implementation of the SADC Trade Protocol started in the year 2000 with the gradual elimination of customs duties on 85% of tariff lines by 2008. For Mauritius, tariffs on the remaining 'sensitive products' were completely eliminated in January 2014.

Member States

The SADC Members States are: Comoros, Angola, Botswana, Democratic Republic of Congo, Lesotho, Malawi, Madagascar, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Swaziland, Tanzania, Zambia and Zimbabwe.

It is to be noted that Malawi, Tanzania and Zimbabwe do not offer full duty access and still maintain duties on a few products while Angola and Democratic Republic of Congo are not participating in the FTA and therefore do not confer any tariff reductions under the SADC Trade Protocol.

The Agreement

Exporting to SADC Countries

Duty Free Access to SADC Member States: Exports between SADC FTA Member States is duty free for all products except for Malawi, Zimbabwe and Tanzania. These countries still maintain customs duties on certain products.

Rules of Origin: The exporter must ensure that the products satisfy the Rules of Origin to benefit from duty-free access. The Rules of Origin are specific to products and can be viewed in the Annex on Rules of Origin.

Obtaining a SADC Certificate of Origin: The SADC Certificate of Origin (CoO) is issued and approved by Customs Department of the Mauritius Revenue Authority. More information on the SADC CoO can be obtained from the Customs Department:

Mauritius Revenue Authority

Customs Department

Customs House

Mer Rouge

Port-Louis

Tel: (230) 202 0500

Fax: (230) 216 7784

Email: customs@mra.mu

Website: www.mra.mu

The online application for the SADC CoO can be made via the TradeNet System.

Scanned copies of the following documents are required for obtaining the Certificate of Origin:

1. Export Declaration

2. Export Invoice

3. Documentary evidence for raw materialsused (such as Import Declaration, Purchase Receipts, etc)

4. Costing Certificate signed by a Certified Accountant (if applicable)

5. Any other relevant information as may be required by Customs

Importing from SADC Countries

All imports entering Mauritius from a SADC FTA Member State with a valid Certificate of Origin are completely exempt from customs duties.

Reporting Non-Tariff Barriers

NTBs refer to restrictions that result from prohibitions, conditions, or specific market requirements that make importation or exportation of products difficult and/or costly.

Operators can directly report any barriers to trade encountered in the SADC region through the Non-Tariff Trade Barriers Website. The system also allows for monitoring of the resolution of the complaint filed.

More information can be obtained on the Non-Tariff Trade Barriers Website or the MCCI which is the national private sector focal point for assisting the business community in the reporting process.

SADC Integrated Regional Electronic Settlement System (SIRESS)

Traders in the SADC region can use SIRESS to settle transactions in RAND between the SADC countries. Presently, the service is available in Barclays Bank Mauritius Limited, Standard Bank (Mauritius) Limited and The Mauritius Commercial Bank Ltd. More information on SIRESS can be obtained from the Committee of Central Bank Governors website.

SADC National Focal Points

List of Focal Points of the NTBs Monitoring Committee (NMC)

Useful Links

Australia

June 1995

Australian Chamber of Commerce and Industry (ACCI)

Austria

September 2014

Austrian Federal Economic Chamber

China

April 1997

China Council for the Promotion of International Trade (CCPIT) - Beijing

China International Economic and Trade Arbitration Commission - Shanghai

November 1998

CCPIT Guangdong Sub-Council

September 2008

CCPIT Qingdao

May 2007

CCPIT Qingdao

Comores

April 2017

L´Union des Chambres de Commerce, d´Industrie et d´Agriculture

Djibouti

August 2008

Chamber of Commerce of Djibouti

Estonia

September 2015

Estonia Chamber of Commerce and Industry

France

September 1996

l’Assemblée des Chambres Françaises de Commerce et d’Industrie (ACFCI)

India

November 1985

Federation of Indian Chambers of Commerce and Industry (FICCI)

May 1996

Confederation of Indian Industry (CII)

June 1995

Tamil Nadu Chamber of Commerce and Industry

January 2004

India International Trade Center

May 2004

Seafood Exporters Association of India

October 2005

Seafood Exporters Association of India

Kenya

January 2011

The Kenya National Chamber of Commerce and Industry (KNCCI)

Madagascar

November 2004

Fédération des Chambres de Commerce, d’Industrie, d’Artisanat et d’Agriculture de Madagascar

Malaysia

August 1994

The National Chamber of Commerce and Industry of Malaysia

June 2005

Malaysian Associated Indian Chambers of Commerce and Industry

Mozambique

September 2012

Chamber of Commerce of Mozambique

Nigeria

June 2019

Nigeria Association of Chambers of Commerce and Industry, Mines and Agriculture

Pakistan

October 2004

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI)

Réunion

June 1995

Chambre of Commerce and d’Industrie de la Réunion

March 2002

L’Association pour le Développement Industriel de la Réunion

Russia

May 2007

Chamber of Commerce and Industry of the Russian Federation

Seychelles

November 2005

Seychelles Chamber of Commerce and Industry

April 2014

Seychelles Chamber of Commerce and Industry

Slovakia

September 2018

Slovak Chamber of Commerce and Industry (SCCI)

South Africa

September 2016

South African Chamber of Commerce and Industry

Sri Lanka

May 2004

National Chamber of Commerce of Sri Lanka

Taiwan

September 2017

Taiwan External Trade Development Council

Tanzania

January 2011

The Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA)

Thailand

August 2004

The Federation of Thai Industries (F.T.I)

February 2013

TUSKON

Turkey

August 2014

DEIK (Foreign Economic Relations Board)

TOBB (The Union of Chambers and Commodity Exchanges of Turkey)